Parameter Setup

When setting up Blocking rules, one of the first things you will want to do is to ensure proper parameter setup. The biggest piece of setup that you will want to define is at what point in time do you want to check the Sales order against the Blocking rules that have been set up?

This is defined by a parameter called Credit management checkpoint. It allows you to select where to run the Blocking rules (at Confirmation, Picking list, Release to warehouse, Packing slip, and/or Invoice) as well as define Grace days before the next checkpoint gets reviewed.

|

| The Credit management checkpoint helps you define how often Blocking rules get processed against Sales orders |

The Credit management checkpoint can be found at Credit and collections > Setup > Credit and collections parameters.

Nine Blocking Rules

There are nine Blocking rules. You can set all of them up, or you can set none of them up. It is entirely up to you how you want to manage your credit hold process.

Within the Blocking rules, there is a concept of blocking and exclusion. Blocking means that you want to block the order from going through if it meets the blocking criteria, or more simply, put the order on hold. Exclusions mean that you will exclude the orders from being put on hold using the criteria provided. Exclusion rules will always trump blocking rules, so keep that in mind!

Likewise, when executing a Blocking rule, you can set the rule to execute on a specific customer by selecting Table, a group of customers, by selecting Group, or All. The hierarchy stands, just like in other parts of the system, that Table supersedes Group, Group supersedes All. In this case, Group is defined by the Credit management group on the Customer record in the Credit and collections FastTab.

|

| Credit management group is assigned on the Customer record |

Credit management groups can be defined in any way you like. If you want to categorically group a subset of customers for credit hold purposes, then you should create a Credit management group. Examples could be high or low-risk customers, volume-related groups, or specific customer groupings, like a company chain, that you want to treat similarly.

Payment and Discount Rankings

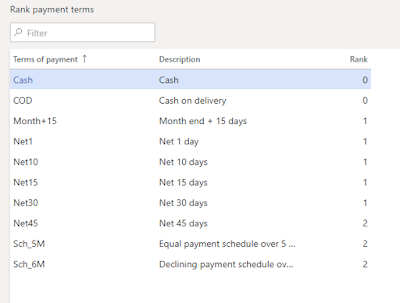

The first two Blocking rules are called Rank payment terms and Rank settlement discounts. They are located at Credit and collections > Setup > Credit management setup. They are listed separately outside of Blocking rules, so that would lead one to believe that they are not utilized in the same manner. However, these are very powerful Blocking rules!

The concept within these Blocking rules is that you will want to review any time someone changes a customer's stated payment terms or settlement discount. This is because a change from Net 30 to Net 90 on a customer's payment terms benefits the customer while putting greater strain on your company.

You can allow for flexibility within this form, such as if a customer makes a request for an order to be Net 15 instead of Net 10. You can enable this by ranking them the same. Rankings determine where a payment term or settlement discount lies in importance to your company. For example, in our picture below, the lowest rank of 0 is assigned to the payment term of COD, whereas the payment term of Net 30 is assigned a 1. If we have a customer who is assigned COD at the account level and someone changes the Terms of payment on a Sales order from COD to Net 30, then the order will go on hold because they are ranked differently. Now, in our example below, you will see that there are several payment terms that are ranked with a 1. You will have some flexibility to modify a customer's payment terms on their sales order between any of those values. Settlement discounts work the same way.

|

| Rank payment terms to protect from someone changing a payment term without permission |

Blocking Rules

There are seven additional Blocking rules listed within Credit and collections > Setup > Credit management setup > Blocking rules. They are as follows:

- Days overdue

- Account status

- Terms of payment

- Credit limit expired

- Overdue amount

- Sales order

- Credit limit used

Days overdue

The Days overdue blocking rule allows you to define how past due you want to allow a customer to become before you start putting their orders on hold. If a customer is listed either at the table level or within a Credit management group that is defined as two days overdue, then if the customer is now past due by two days, their orders will be sent to the hold queue. You can also set up a rule for All that will encompass all customers not previously affected by a table or group rule.

Account status

Account status will allow you to drive a blocking rule based on Account status. While the Account status drives the Invoice and delivery on hold field, you may want to have additional rules surrounding specific statuses like Bankruptcy.

Terms of payment

At times, a specific term of payment will want you to scrutinize a customer's orders a little more closely. This is typically used in COD scenarios.

Credit limit expired

If you are using credit limit expiration dates, then this blocking rule will be an excellent way to keep tabs on credit limits that are not getting updated promptly.

Overdue amount

Similar to Days overdue, the Overdue amount blocking rule will look at the dollar amount that is past due, rather than the days. You may want to offer some leeway for smaller amounts, but if it gets past a specific amount, then put the order on hold.

Sales order

The way that Sales order works is that it allows you to block customers from placing orders that exceed a specified amount. For example, you may not want any customer placing an order greater than $100,000. Likewise, it allows for exclusions. You can put an exclusion rule stating that any order less than $1000 won't go on hold.

Credit limit used

This is an easy one. Most people just set this to 100% of credit used, put the order on hold. There may be instances where you may want to only allow 80% of a credit limit to be used before reviewing an order, but this is rare and can often be handled by temporary credit limits.

Credit Management Hold List

The sales orders that go on hold for violating the terms of a blocking rule will go to a queue for review. This queue is located at Credit and collections > Credit management hold list > All credit holds. This will show all credit holds that have been applied, both active and inactive. There are also filtered views called Open credit holds, Closed credit holds, and Credit holds due for review.

|

| Credit management hold list |

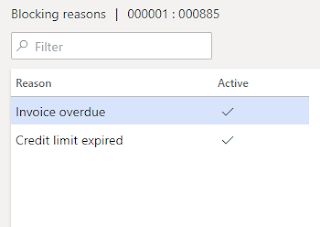

When an order is placed on credit hold, this form will allow you to see why the order was put on hold by selecting Blocking reasons or reviewing the line. In my example, the order was put on credit hold for multiple reasons. The line would say Multiple, and you can select Blocking reasons to see all of the reasons your order may have been put on credit hold.

|

| Blocking reasons explain why the order was put on credit hold |

You can also Release, Reject, or Evaluate for release. Release and Reject mean exactly what they say. You can release or reject the order after review. Evaluate for release allows you to re-run the blocking rules against the Sales order that is on credit hold. This is especially beneficial if the blocking rules have changed or if the customer has paid their past due balance or had an updated credit limit.

Conclusion

Blocking rules are a powerful new tool that can be implemented very quickly. They allow your credit team the ability to have greater insight into a Customer's activities. Once implemented, having the automation of putting a Sales order on credit hold and being able to review it before releasing or rejecting it will take away the pain of manually tracking Customer holds and their subsequent transactions, allowing you greater flexibility and visibility into your Customer credit cycle.

No comments:

Post a Comment