When creating Automatic credit limits, you can create a set of rules that will take specific criteria into account while quickly and easily applying credit limits. Navigate to Credit and collections > Setup > Risk > Automatic credit limits to begin.

Automatic Credit Limits

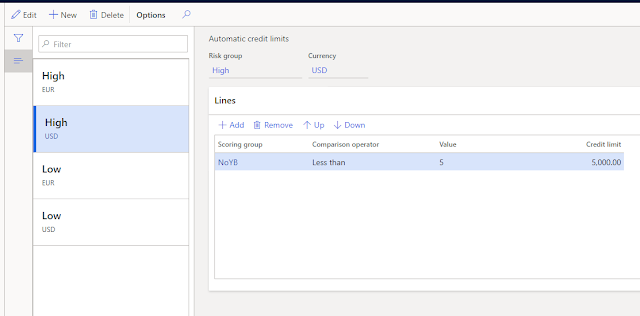

When defining Automatic credit limits, you will use the Scoring groups that were created for Risk scores.

|

| Definitions for Automatic credit limits |

In the above example, Customers that are in the "High" Risk group, with Currency USD, who have been in business less than 5 years will be given a Credit limit of $5,000.

The following Customer meets the criteria specified, and when the Automatic credit limit rules are applied, will be assigned a $5,000 Credit limit.

|

| Customer FR-004 will have a credit limit of $5,000 automatically applied |

Applying Automatic Credit Limits

Automatic credit limits get applied at the Credit limit adjustment journal. Navigate to Credit and collections > Credit limit adjustments. Create a new Credit limit adjustment journal. When the journal has been created, open the Lines and click Generate. From there, select Automatic credit limits to run and apply Automatic credit limits.

|

| Click Generate to create Automatic credit limits |

Once complete, you should have new Credit limit adjustment journal lines that meet the criteria specified in the Automatic credit limit rules you created.

|

| Automatic credit limit line has been created |

When you are ready, you can Post the journal and the new Credit limit will be applied to your Customer.

No comments:

Post a Comment