Part of the new Credit management feature is the ability to calculate Risk scores for your Customers. There is a little bit of setup initially, but the value that can be derived from calculating a Customer's potential risk is tremendous!

Setup Scoring Groups

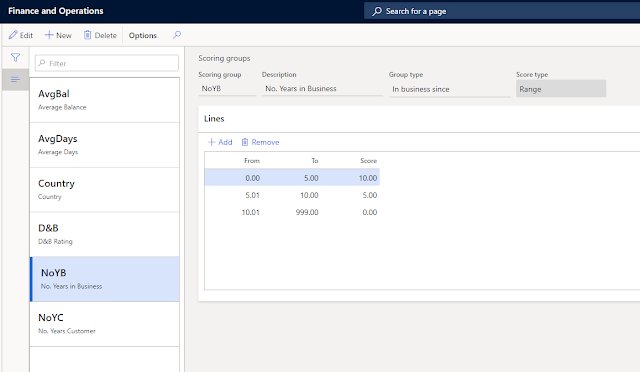

The first step is to define what Scoring groups you would like to use to help categorize your Customers. Navigate to Credit and collections > Setup > Risk > Scoring groups. Here, you will define what criteria will define how you weigh the Customer's risk factor.

When defining a new Scoring group, you must select what Group type this Scoring group will be defined as. These scoring groups have functionality built into them that will use fields in the system to calculate values.

|

| Scoring groups - Define Group type |

You can define the following:

- User defined

- Average payment days

- Customer since

- In business since

- DSO (12 months)

- Average balance (12 months)

- Credit management group

- Account status

- Country

User defined is just like it sounds. This is a group that is defined by you! The system allows for flexibility if you want to create your own method of risk scoring. In the Contoso demo data, there is a great example of D&B Ratings (as seen below). As you can see, the worse your D&B rating, the higher your risk score.

|

| Scoring group using D&B ratings |

Average payment days is a calculated value. The system tracks this data and supplies it in a field that is tucked away within the Collections information on your Customer record (yes, this is in older versions of AX as well, just super hidden!). You can easily access this information in D365FO on the Related information pane, in the Credit statistics area.

|

| Average payment days |

|

| Easily calculate how long a Customer has been in business |

Risk scores

Once you have defined the Scoring groups, you must now determine how they will calculate into Risk scores. Navigate to Credit and collections > Setup > Risk > Risk classification. Here you can define the levels of risk. Typically, Risk will fall into low, medium, and high categorizations and you can assign visual indicators that will appear throughout the system to help you quickly and easily assess a Customer's risk level.

|

| Risk classification with indicators |

Calculating Risk

Ok, this is all great information, but how do we actually calculate the Customer's Risk scores and where can we see this information?

There is a task located at Credit and collections > Periodic tasks > Credit management > Update risk scores. This is a job that can be set to run in the background or you can run it periodically on your own.

You can review the Risk scores that get calculated on the Customer record. Navigate to the Credit management tab in the ribbon and select Risk score.

|

| View Risk scores on the Customer record |

This is where you can see the calculated and user defined risk contribution values for your Customer.

|

| Risk score and Risk classification |

From here, you can use the Risk score to generate Automatic credit limits.

No comments:

Post a Comment